per capita tax revenue

It can apply to the average per-person income for a city region or country and is. Dollars per capita in tax revenue.

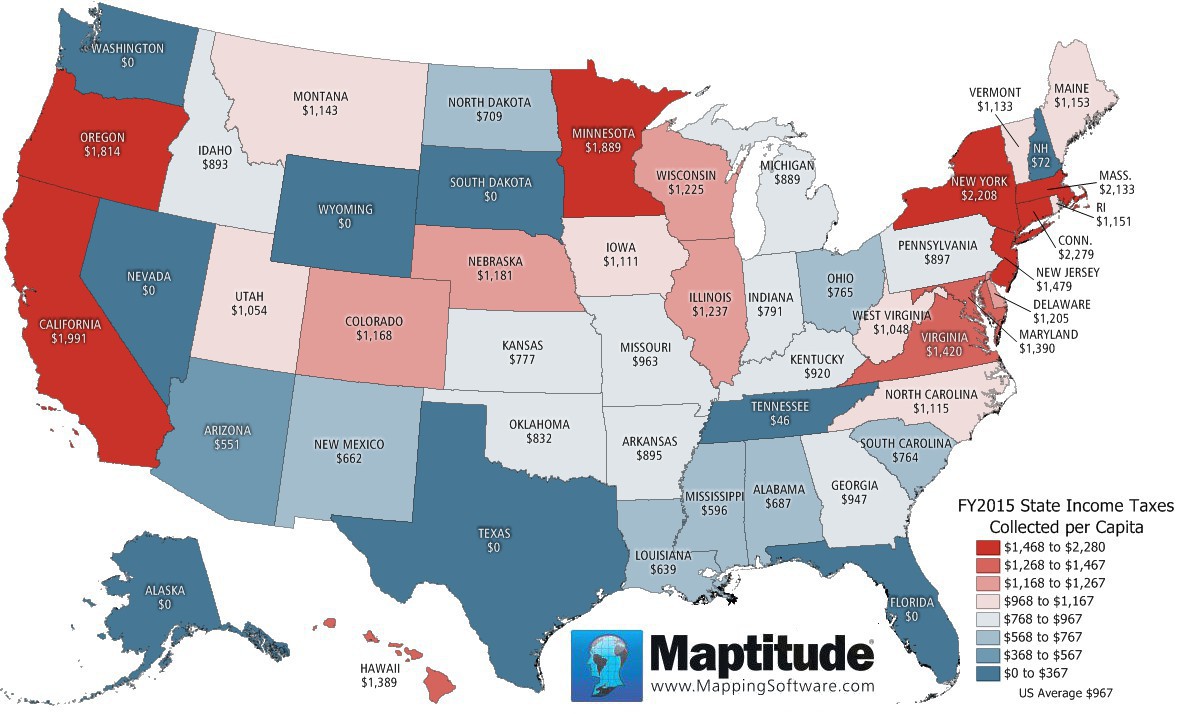

Us State Tax Revenue Per Capita 2015 Oc R Dataisbeautiful

Disposable income deducts from gross income the.

. The following table represents data from OECDs median disposable income per person metric. Income per capita is a measure of the amount of money earned per person in a certain area. This is an increase from the previous year when state.

Per capita values are based on population estimates from the. Municipalities and school districts were given the right to collect a 1000. Per capita state and local tax revenue 1977-2020.

Per Capita Tax is a tax levied by a. In 2019 state and local governments in the United States collected about 5664 US. TX Per Capita Government Revenue.

Per capita also means per person and According to Berkheimer Tax Innovations The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing. 188 rows This article lists countries alphabetically with total tax revenue as a percentage of gross domestic product GDP for the listed countries. What is per capita tax.

Total US government estimated revenue for 2023 is 822 trillion including a budgeted 464 trillion federal a guesstimated 229 trillion. This tax is due yearly and is based solely on residency it is NOT dependent upon employment or property ownership. New York has the highest per capita local general revenue from its own sources at 5463 while Vermont has the lowest at 1230 per capita.

Research and Tax Rates. This tax is due yearly and is based solely on residency it is NOT dependent upon employment or property ownership. And not the entire revenue collected by the IRS.

State government tax revenue 2021 by state. State tax levels indicate both the tax burden and the services a state can afford to provide residents. States use a different combination of sales income excise taxes and user.

FTA Revenue Estimating Conferences. Income tax is the preferred method at the federal and state levels. Median equivalent adult income.

Per Capita Total Government Revenue in the United States Federal State and Local Fiscal Year 2023 Income Taxes 10821 person Social Insurance Taxes 6134. The tax percentage for each country. Tax revenue is defined as the revenues collected from taxes on income and profits social security contributions taxes levied on goods and services payroll taxes taxes on the.

This is a table of the total federal tax revenue by state federal district. New Jersey has the highest per.

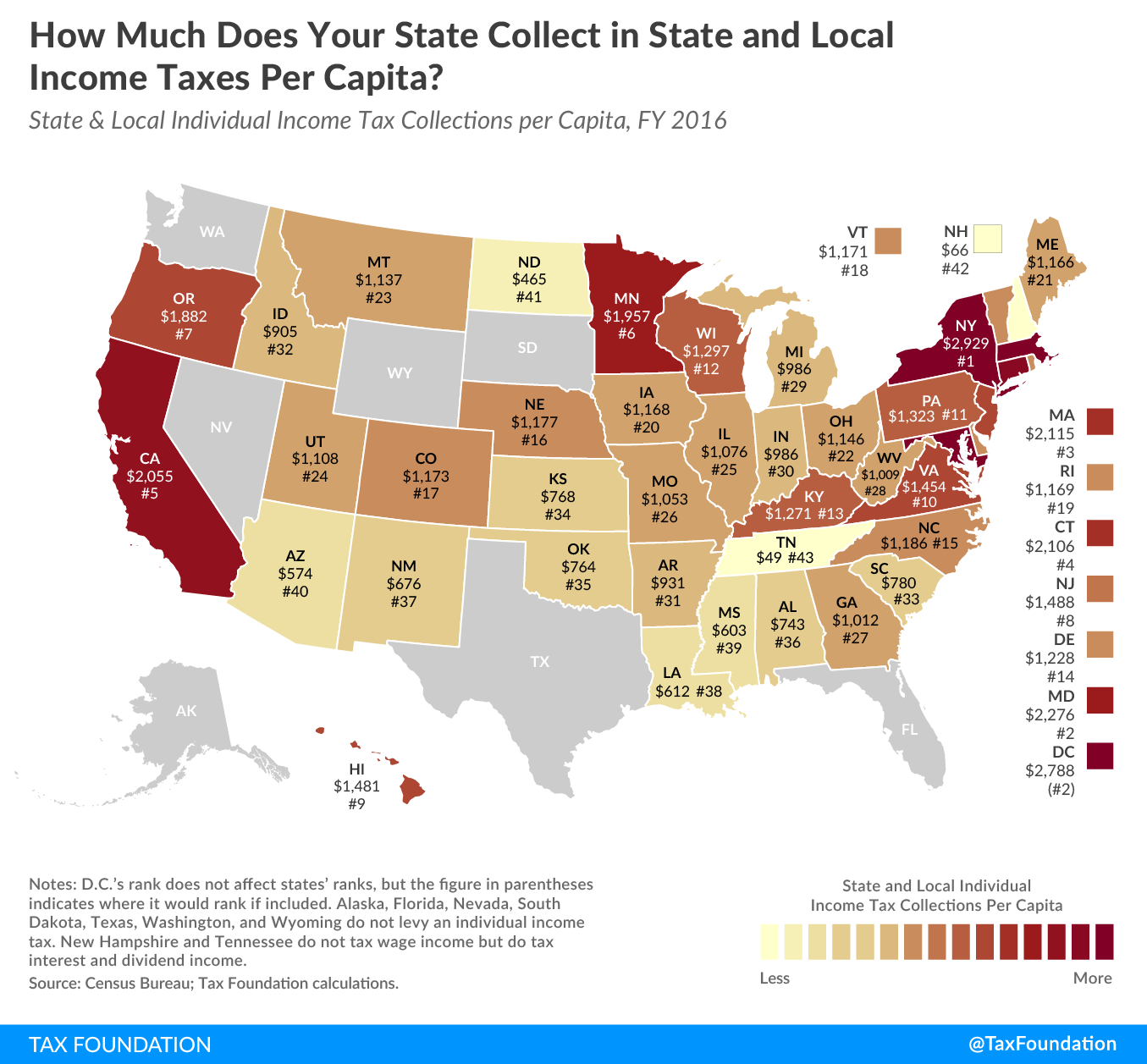

Map State And Local Individual Income Tax Collections Per Capita Tax Foundation

Income Tax Revenue In France Statista

Non Tax Revenue Oklahoma Policy Institute

Fiscal Facts Tax Policy Center

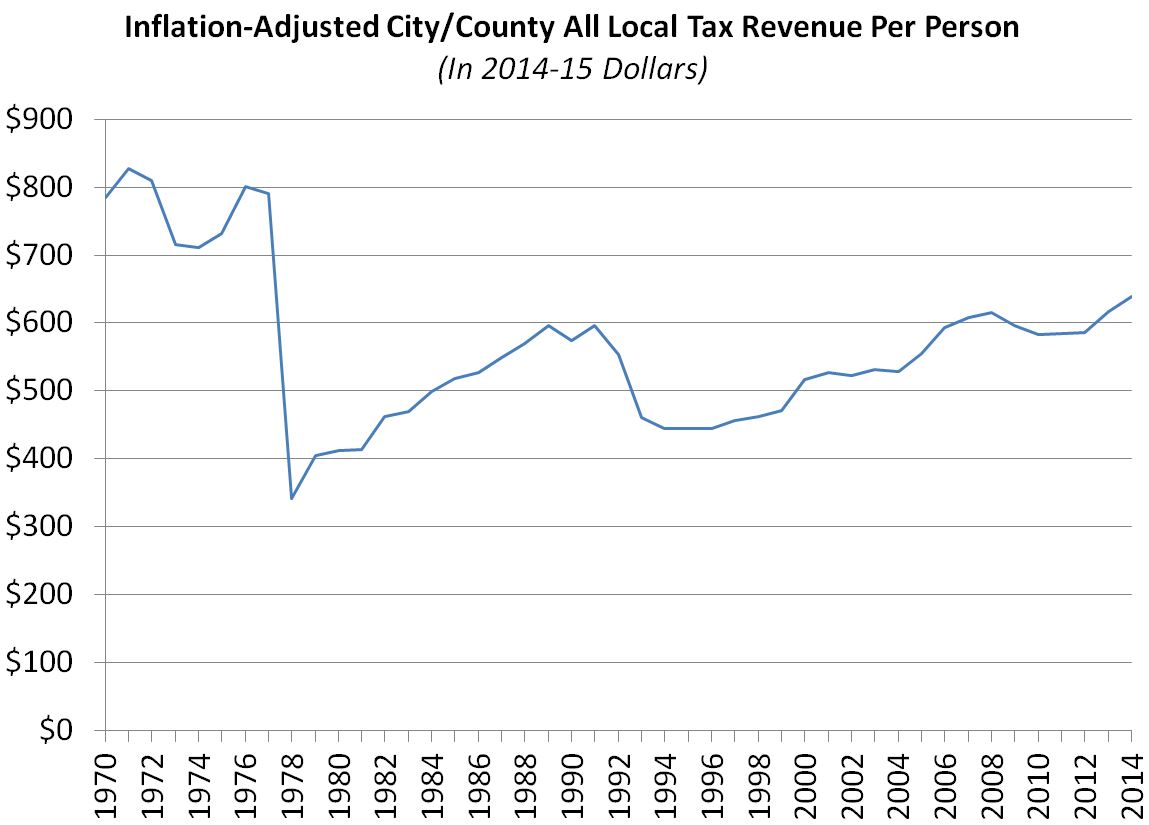

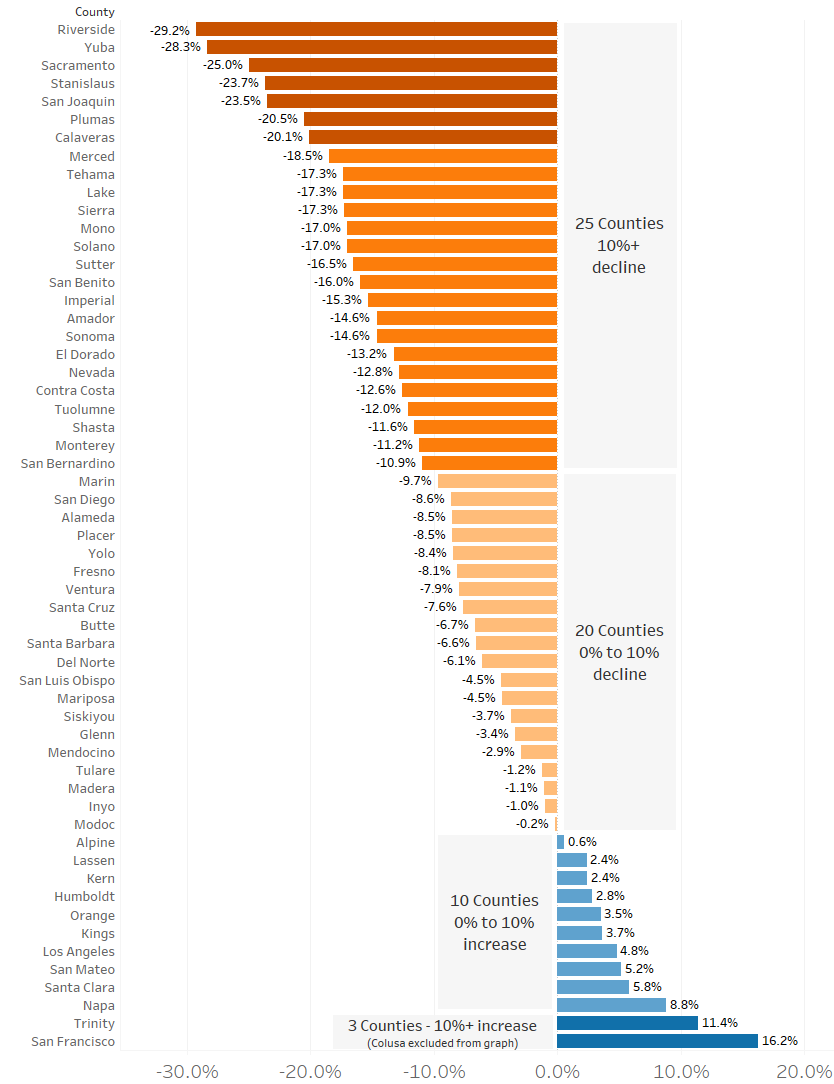

Proposition 13 Report More Data On California Property Taxes Econtax Blog

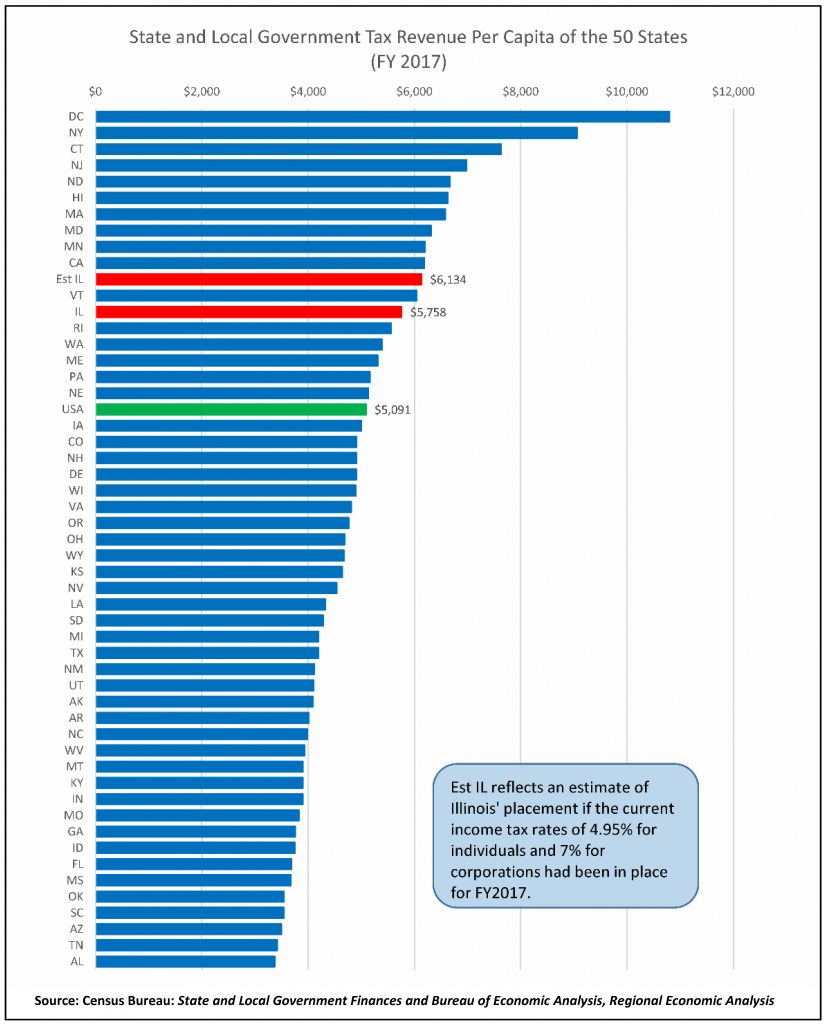

Taxpayers Federation Of Illinois Tax Facts An Illinois Chartbook Overall State And Local Taxes Maurice Scholten

Michigan Ranked 31 Nationwide For Amount Of Taxes Per Capita Drawing Detroit

Property Taxes Still Below Pre Recession Peak California State Association Of Counties

Indiana Tax Revenues For Expenditures Compared To Other States

Economic Growth And Tax Revenue Sofia

Tax Burden Per Capita Other State Austin Chamber Of Commerce

How Oklahoma Taxes Compare Oklahoma Policy Institute

Annual Tax Revenue Per Capita Daily Urban Wage Between 1500 1789 In Selected Countries R Europe

Tax Burden Per Capita Other State Austin Chamber Of Commerce

Income Taxes Per Capita How Does Your State Compare 2019 Update

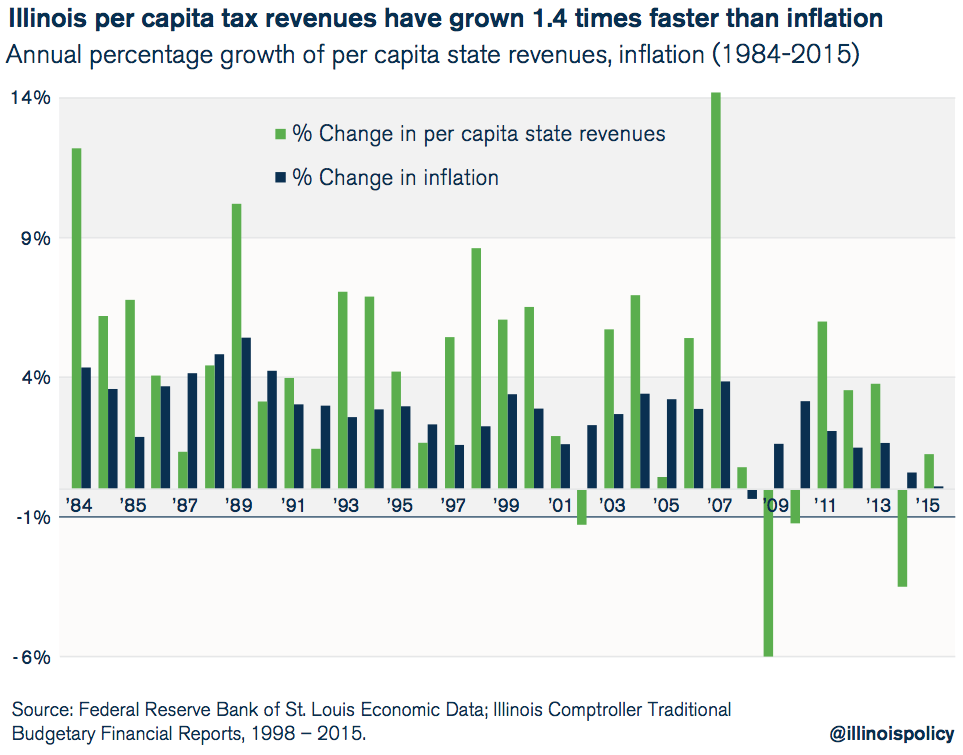

Illinois Has A Spending Problem Not A Revenue Problem Illinois Policy

Total Tax Revenues 1980 To 2019

National Tax Day April 18 2022

Oecd Tax Revenue As A Share Of Gdp Per Capita Tax Policy Center